When applying for an unsecured personal loan, the vast majority of borrowers will select a loan with a fixed interest rate and monthly payment. While unsecured loans and loans without collateral are the most common forms of personal loans, other options exist. The ideal type of loan for you will depend largely on your credit history and how much time you have until you need to start making payments on it.

There is typically no need to put up valuables like your home or car in order to get approved for an unsecured personal loan. Because of this, the annual percentage rate (APR) that they pay may be slightly higher than what they would be with a less risky borrower. The interest paid plus any costs associated with the loan are what make up the annual percentage rate (APR).

In order to determine whether or not you are approved for an unsecured personal loan and at what interest rate, lenders look at your credit history, monthly income, and other financial commitments. Typical interest rates range from 6% to 36%, and loan terms can be anywhere from two to seven years.

If the borrower fails to make their loan payments, the lender may take possession of the loan’s collateral to recoup their losses. Mortgages, which rely on the value of the home as collateral, and auto loans are the two most popular types of secured loans.

In some cases, borrowers can secure loans against their own money or other assets from financial organizations like banks and credit unions. Borrowing against your car is a common option with internet lenders who offer secured personal loans. In general, the interest rate on a secured loan will be lower than that of an unsecured loan because the former is thought to have less of an effect on the borrower’s financial situation.

The interest rate and the monthly payments, also known as installments, on a personal loan are typically fixed and won’t change during the loan’s term.

Borrowers who are concerned about their ability to keep up with their monthly payments in the event of interest rate increases might consider fixed-rate loans. A fixed interest rate makes budgeting considerably easier because you’ll know exactly how much you’ll have to pay each month.

Lenders commonly peg the interest rate on variable-rate loans to some sort of predetermined benchmark rate. If the rate used as a comparison changes, so may your interest rate, your monthly payment, and your total interest paid over the life of your loan.

The annual percentage rate (APR) for a variable-rate loan can be lower than the APR for a fixed-rate loan. They may also have an interest rate cap that limits the maximum rate increase or decrease during the life of the loan.

In light of the fact that interest rates could rise in the future but are unlikely to skyrocket, a variable-rate loan could make sense if the loan’s payback period is relatively short. Loans with variable interest rates are not as widely available as those with fixed rates.

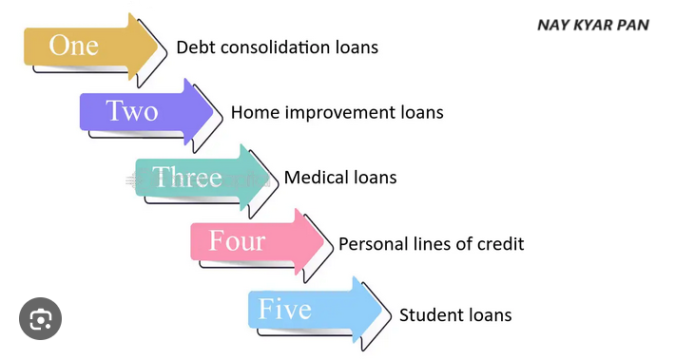

To simplify your financial life, consider applying for a debt consolidation loan to roll all of your current debts into one easy-to-manage installment loan. Consider combining your debts if the interest rate on the new loan is lower than the average interest rate you were paying on your old loans.

If you need money and don’t qualify for a personal loan but would like to borrow money, a co-signer or joint loan may be the way to go. In the event that the borrower cannot repay the loan, the co-signer assumes responsibility for doing so and takes on the financial obligation in exchange for a promise of repayment. Borrowers on a joint loan are jointly and severally liable for all loan obligations, but each individual borrower retains the right to use his or her portion of the borrowed funds if the primary borrower defaults on payments.

If you have a co-signer or co-borrower who has excellent credit, you have a better chance of getting a loan and can negotiate better terms and a lower interest rate.

A personal line of credit is revolving credit that functions more like a credit card than a loan. Instead of receiving a lump sum, you will be given a credit line from which to make withdrawals as needed. Ultimately, all you do is pay interest on the money you borrow. As opposed to a traditional loan, a personal line of credit allows you to borrow money on an ongoing basis, making it ideal for unexpected expenses and recurring demands.