To put together a monthly budget, simply list all of your monthly income and expenses. Developing and sticking to a spending plan is the first step to regaining financial stability. Creating and adhering to a budget is a certain way to keep track of your expenditures and make sure you’ve considered every possibility. Finding new methods to cut costs and save money is possible. As monthly is probably when you’ll be paying household expenses and debts, it’s important to keep track of all of these figures on your budget calendar.

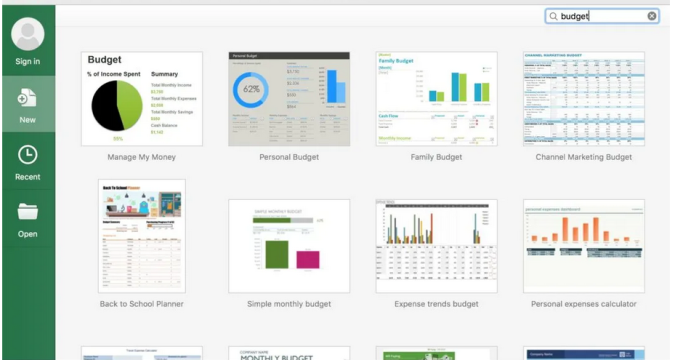

The first step in setting up your budget planning sheet is to make a new Excel file. Make a new sheet in your chosen spreadsheet program to do this. It is appropriate to give your financial counselor a proper name. In this scenario, the monthly budget is as straightforward as it gets.

Find out what legal structure best fits your company’s approach to handling money. A spreadsheet, for example, can help you organize your monthly expenses in one place, or you can divide the page into tabs for each month to get a more detailed view.For the time being, let’s pretend you want to manage your entire annual budget on one sheet of paper. Go to Column B and record “January” there. After that, type “February” in column C, then “March,” and so on until all 12 columns include the months of the year.

Let’s pretend you’ve navigated back to the first column of the spreadsheet and are ready to enter “Income” on the second line. Create a new spreadsheet and title each column “Revenue” to keep tabs on your monthly cash flow. On the line labeled “Income Total,” please provide the final tally of your earnings. Earnings can be entered into the spreadsheet cells and then added up using a simple formula you write. Choose the “Income Total” column and then the blank space to the right of the column heading to complete the task. After that, select “Autosum or Sum” from the main menu. Following that, pick the empty cells in column B (to the right of each new revenue source) with your mouse and then hit the enter key. After you enter your money into the fields, the spreadsheet’s autosum function will add everything up for you. Go on in this fashion, moving rightward inside the same row by one each month.

Estimated expenses might be entered in the corresponding column. Around two rows below where you list “Income Total,” Each type of expenditure you intend to include in the total should have a label next to it. Take a look at your most recent financial records (such as a bank or credit card statement) to get an idea of how a typical month of spending looks for you. After you’ve entered each category of spending, write “Total Costs” in the final spot of column A. Then, in the same way that you did with your income, you should make use of an autosum formula for your expenses across all 12 months of your spreadsheet. Inputting last month’s spending information will reveal your spending categories along with the total for the month.

You’ve come a long way with the budget planning sheet you’ve been making. Replace the label that appears in the two cells underneath “Total Costs” with the new one. The “Gap” can be defined as one’s monthly income minus one’s monthly expenses. Just delete this label in the empty cell to its right. To begin the calculation, choose the starting point and then click the Autosum button. Check this box if you want to include this sum when calculating your take-home pay. The next step is to click the dash (-) button on your keyboard. Keep holding control as you click the number that appears in the “Total Costs” field, and when you’re done, you can release the keys. To get your expenses removed from your income without further keypunching, just hit the enter key.

It can be a bit of a learning curve to create a budget using a spreadsheet if you’re used to a different system. Keeping track of minor expenditures on a separate budget sheet before incorporating them into major budget categories may prove useful. This will allow you to examine your spending habits in greater detail and identify the leaks in your financial armor. Let’s say you realize you need to update your budget by including new sources of money or eliminating areas that aren’t relevant to your current situation. If that’s the case, you need to revise your classifications of income and expenditures. If you take the time at the end of the year to compile a summary of the preceding 12 months, you’ll have a solid foundation on which to base your budget for the coming year.